12 Things You Should Do To Save Big This Year

There’s no reason why everyone hasn’t used at least one of these incredible money-saving tricks.

No matter where you are on your financial journey, it’s always possible to find ways to keep more of your hard earned money. No one wants to shell out more money every month than they have to.

Being a responsible adult comes with much more responsibility and stress these days. Making mortgage payments, keeping up with repairs, dealing with higher utility bills to name a few.

Fortunately, there are some little-known tricks to save Americans thousands per year. Use this guide to see how much you could save your family!

1. Automate Your Thermostat

One of the easiest things you can do to instantly start saving money on your heating and cooling bills is to get an automated thermostat. These smart thermostats will learn when you are home and make sure the home is at a comfortable setting during those hours.

You may even be able to get a rebate from your utility provider for installing one of these in your home. It’s a win-win!

2. Pay Your Mortgage On Time? Refinance With The Government’s Lucrative “FMERR” Program To Cut Your Mortgage Down

Banks Don’t Want Homeowners Knowing This

Still unknown to many is a brilliant Government Program called the Freddie Mac Enhanced Relief Refinance Program (FMERR) that could benefit millions of Americans and reduce their payments by as much as $3,000 per year! You could bet the banks aren’t too thrilled about losing all that profit and might secretly hope homeowners don’t find out before time runs out.

So while the banks happily wait for this program to end, the Government is making a final push and urging homeowners to take advantage. This program is currently active but could be shut down at any given time in 2019. But the good news is that once you’re in, you’re in. If lowering your payments, paying off your mortgage faster, and even taking some cash out would help you, it’s vital you act now and see if you could qualify for FMERR or a better rate in today’s marketplace. URGENT: So many homeowners could still benefit today, but sadly, many perceive FMERR to be too good to be true. Remember, FMERR is a free program and there’s absolutely NO COST to see if you qualify. See if you qualify now before it’s gone >>

How Do I Qualify?

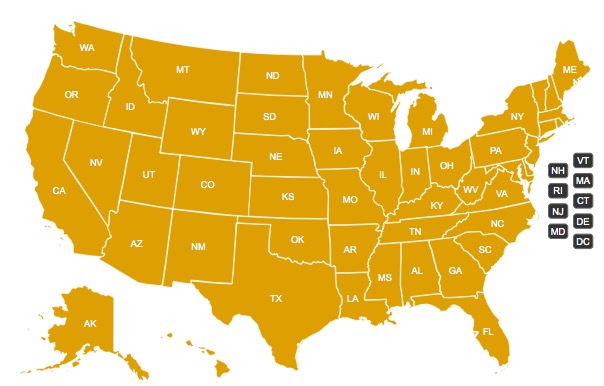

Step 1: Click your state on the map to instantly check your eligibility for free.

Step 2: View your new lower rate and save money! Click here to see your new low rate.

Select Your Current State:

3. Get Solar Panels

Warning: Do not pay your next energy bill until you read this…

This is the 1 simple truth your power company doesn’t want you to know. There is a new policy in 2019 that qualifies homeowners who live in specific zip codes to be eligible for $1,000’s of Government funding to install solar panels. Has your power company told you that? Of course not. They hope homeowners don’t learn about this brilliant way to reduce your energy bill tremendously!

When homeowners check whether they qualify many are shocked that subsidies and rebates can cover a lot of the costs associated with installation so it greatly reduces the amount you’ll have to pay. Many may qualify for $0 down! Soon, you could be on your way to significantly reducing your electric bill in a matter of weeks.

Smart homeowners are setting out to do their own research and determine whether this new program lives up to its reputations. Over and over again, many are reporting back on their findings, with the most exciting part being that they are now able to save $1,000s a year on their own energy bill.Estimate Your New Power Bill >>

4. Hang Out Your Laundry

The thought of having to take your laundry outside to hang and dry can be a turn-off for some. But what if you just skip the dryer and hang them to dry in your closet? Save on energy costs by doing this!

5. Get A Home Warranty

Still unknown to many is a brilliant Home Warranty Program called the Choice Home Warranty that could benefit millions of households and help them never pay for covered appliance failures, furnace breakdowns, electrical issues and so much more! You likely have homeowners insurance, right? A Home Warranty Plan is similar to a homeowners insurance plan, but it actually covers many things that an insurance plan won’t like a broken refrigerator, a broken furnace or an electrical malfunction on a ceiling fan.

Often times, new homeowners are offered a 1 or 2-year home warranty plan when they purchase a home. This is generally a huge plus for the home buyer because it takes away the stress of having to pay for likely issues that might come up during the first year or two of owning the home. Issues such as a broken refrigerator or dishwasher aren’t fun to deal with. Or how about a broken furnace or air conditioner? These would likely cost $1,000s of dollars to fix!

Luckily, homeowners now have the option to get a home warranty plan anytime after they bought their home. Even if you’ve lived there for 20 years, you can still get your own home warranty plan that will cover the cost of many unforeseen home repairs!Get Your Free Quote Now >>

6. Childproof Your Outlets Even If You Don’t Have Kids

If you have an older home, the exterior walls may be poorly insulated. And when you have poorly insulated walls, the holes that your outlets are in can be areas where the outside cold/heat can enter your home.

A simple solution to this is to install child-proof outlet plugs in any unused outlet on an exterior wall. This will close the gaps and reduce the amount of air that can leak through.

7. Grill!

Here’s an easy money-saving tip: Grill in the summertime! When you use your stove or oven to cook, it creates a lot of heat. And in the summertime, it can make your air conditioner work extra hard. If you’re not much of a griller, consider cooking meals in a crockpot.

8. No Life Insurance? You’ll Want To Use This Brilliant Life Insurance Trick

If you don’t have life insurance, you better read this.

It’s not something any of us like to think about or plan for. But when the worst happens, it’s essential to know your family and loved ones are covered financially. That’s why it’s essential to have a life insurance. A good life insurance policy can help cover the cost of a mortgage, childcare costs and safeguard your family from inheriting any debts you might have.

But the sad truth is, a shocking number of Americans do not have a life insurance policy and their family is at financial risk if the worst should happen.

There is a service called National Family that is now allowing users to get free life insurance quotes from some of the top insurance companies out there. People are shocked at how cheap an excellent policy is after requesting their free quotes. But the reality is, life insurance rates are at a 20-year low and thanks to new program policies you could qualify for a great new policy at an extremely affordable price.

To get your free quote today, click below and complete a few questions (about 60 seconds). Once you’re done, you will be presented with choices and rates you never thought possible (no login required). Enjoy your savings! Get Your Free Quote Now >>

9. Give Your Air Conditioner Some Space

Just like we need to breathe, your air conditioner needs space where it’s getting air easily. Many AC units are surrounded by shrubs that can restrict the airflow it needs to run efficiently. Take a few minutes this weekend and do the following:

Trim up any bushes that are are touching the unit so there is at least 1 foot of clearance

Clean up the ground for any loose debris or leaves

If the outside of the unit has a lot of debris clogging it up, consider having a professional service and clean it out

10. Groom Your Pets

We started taking our dog to a groomer this past year and although we do love having it done, it’s quite costly. It can cost between $50-$100 each time. Save yourself some major cash and give your pet a bath and a good brushing.

11. Use This Debt Payoff Plan

Here’s what credit card companies don’t want you to know…and what thousands of consumers are quickly learning about paying off their debt:

If you owe more than $15,000 in credit card debt, this proven debt relief program may reduce the amount you owe. Consumers could resolve their debts with absolutely no loan required and pay it off at a rapid pace. If you’ve struggled to pay your credit card debt, act now before your debt balloons further.

Learn The Secret To Resolving Debt >>

12. Meal Plan

Consider making weekly meal plans in advance to save a lot on food. When you plan your meals out, you can resist the temptation of spending money on take-out or fast food. You can also plan our a healthier diet this way too!

You don’t need to buy a cookbook either. Thanks fo the internet, there are TONS of free recipes online. Ever heard of Pinterest? Give it a try!